New industry research shows ‘Gen Z’ and public sector workers turning to BTR for longer leases and free amenities in a challenging rental market

- Analysis of 32,000 renters in 80 developments across the UK provides unique insight into the emerging Build to Rent (BTR) sector.

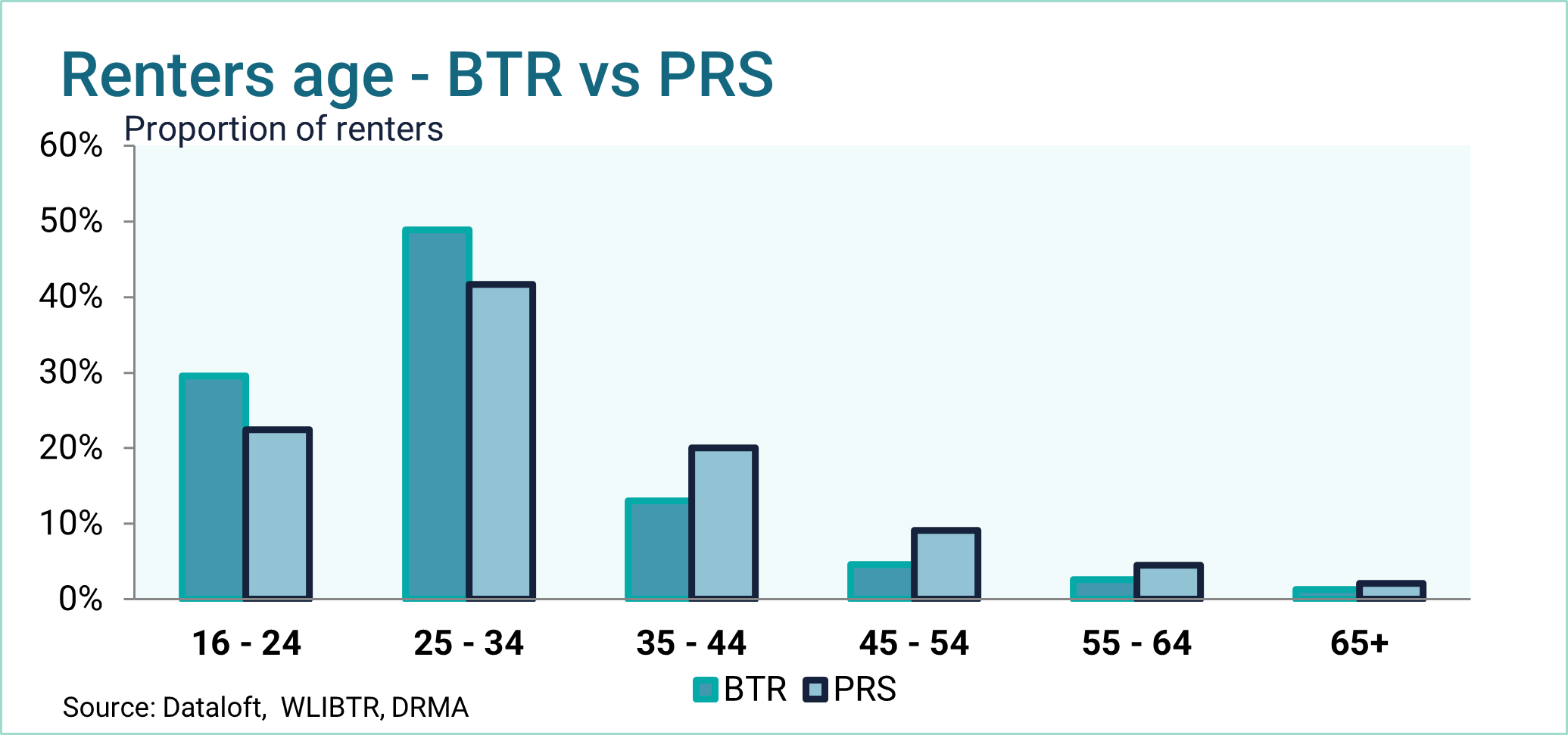

- ‘Gen Z’ is embracing BTR, making up 30% of tenants, compared to 22% in the wider Private Rented Sector (PRS) market.

- Those earning between £26,000 and £31,999, below the national average, are the most common income band for BTR, while the proportion of public sector workers matches the wider PRS market.

- 80% of BTR schemes offer 3 year leases, with pet-friendly policies and free amenities such as co-working space attracting tenants.

New analysis published today by the British Property Federation (BPF), the Association for Rental Living (ARL), BusinessLDN, and PriceHubble, shows the rising popularity of the UK’s Build to Rent (BTR) sector across an increasingly broad range of renters, including the ‘Gen Z’ age group and public sector workers, as well as sharers and couples.

The report, Who Lives in Build to Rent?, which is now in its sixth edition, underlines the broad appeal of BTR developments in the UK, with free amenities, longer leases, and pet-friendly policies drawing in tenants as the wider PRS market suffers a shortage in the supply of homes for rent. The survey, one of the largest of the BTR sector in the UK, presents data from almost 32,000 renters living in 22,800 homes across 80 Build to Rent schemes.

‘Gen Z’, couples and sharers embrace BTR

The dominant age group in both BTR and the wider PRS is 25 – 34 years (49% vs 42%), but the proportion of renters in the 16-24 age group is significantly higher in BTR (30%) than the wider PRS (22%), underlining BTR’s popularity with ‘Gen Z’ renters. BTR developments also house a much higher proportion of couples and sharers, who make up 59% of BTR households, versus 41% of the wider PRS.

The Public Sector is an important employer for those renting in BTR, representing 17% of residents, which is consistent with the wider PRS. Employment in Finance and Professional services is also consistent with the wider PRS, accounting for around 25% of roles in each, however this has fallen from 33% in the previous report as the range has broadened.

Affordability, leases and amenities

The BTR sector is increasingly providing homes for those earning less than £32,000, demonstrating its broadening appeal in a market where rents are rising and supply of rental properties is short, especially in London. The UK median average annual salary is £35,000 demonstrating that BTR is a housing option for a wide range of households including those on lower than average incomes.

The most common income band for renters in BTR is £26,000 to £32,000, while in the wider PRS it is £19,000 to £26,000. This also contrasts with the emerging Single Family Housing (SFH) market, where the most common income band is £19,000 to £25,999 in line with the PRS market as a whole. The proportion of middle income earners is similar for both BTR and the PRS with incomes between .£26,000 and £50,000 accounting for 43% (BTR) and 45% (wider PRS). There is some differentiation at the top end – BTR has a higher proportion of high earners, with 25% of renters earning over £68,000 compared to 14% in the wider PRS.

The average rent for BTR is between 15% and 25% higher than the average in the wider PRS, depending on property type. In BTR, the average monthly rent for a 1-bed flat in London is £1,443 and £1,127 outside of London, while a 2-bed flat is on average £1,811 in London and £1,431 outside of London. However, the affordability ratio (rent as a proportion of income) is similar, sitting between 29% and 33% of household income for BTR and between 26% and 31% of household income for the wider PRS.

While rents are higher on average in BTR developments, tenants receive access to onsite amenities and services free of charge, along with the benefit of professional customer service on call. These free services allow residents to get more for their money and help to support the affordability of BTR developments. The top three amenities provided by BTR developments at no extra charge are a Social Calendar and Events (92%); a Shared Roof Garden or Terrace (82%), and a Concierge (81%). 74% of BTR developments offer co-working or meeting spaces, 72% provide free internet, and 66% include a gym. Typically, as much as 8% of the total floor space in BTR developments is dedicated to shared amenity spaces. With the majority of BTR buildings newly built, residents also benefit from highly energy efficient homes, providing cost savings on energy bills.

On leases, the survey reveals that 80% of BTR schemes offer 3-year leases and 18% of currently active leases are for 3 years. 56% of tenancies were also renewed over the past 12 months. 70% of BTR developers allow tenants to keep pets in all of their units.

Next Government must provide a strategy to deliver more homes for rent

The emerging BTR sector has in the past year seen a slowdown in delivery partly as a result of planning delays. The BPF’s quarterly BTR research, conducted in collaboration with Savills, found that the number of completions of new BTR units (14,500) now outpace new starts on an annual basis (12,500 in total).

The BPF, which launched its 2024 manifesto Building Our Future earlier this year, is calling for government to partner with the industry to give investors the long-term confidence to boost the delivery of new homes for rent, with a target of 30,000 BTR homes per year.

Melanie Leech, Chief Executive of the British Property Federation, said: “This research provides a fascinating insight into how Build to Rent is changing the rental market in the UK and providing new, high-quality homes, which appeal to a wide range of tenants. The additional homes that the BTR sector can provide are taking some pressure off the wider rental market, where the limited supply of available properties is driving up rents. Billions of pounds are being invested by the sector into inner city areas, helping to regenerate and bring new life to city centres. Institutional investment is delivering more high-quality homes for private rent, and working in partnership with policymakers, the sector has the potential to do much more to increase housing supply and support communities.”

Kurt Mueller, Director of Corporate Affairs at Grainger plc, the UK’s largest listed residential landlord and BTR market leader said: “Build to rent provides homes to a very wide range of households and incomes, including those on low and middle incomes. This reports categorically confirms that. With many BTR properties providing additional free services like super fast Wi-Fi and gyms, the sector is focused on providing good value for money and great customer service to our customers, whilst preserving rental affordability. At Grainger, we provide over 11,000 rental homes and we are investing over £1.5bn to deliver a further 5,000 new BTR homes, which demonstrates how BTR can deliver much needed new homes, and be part of the solution to the housing crisis,

Brendan Geraghty, Chief Executive of the Association for Rental Living (ARL), said: “This report highlights the benefits that Build to Rent brings to residents in terms of professional management, customer service, amenity provision, security of tenure and overall value for money. The findings demonstrate that BTR is becoming increasingly desirable to a broader demographic, and the high level of tenancy renewals show the satisfaction of customers in BTR. We see this as further evidence of the attractiveness of BTR to consumers, providing high quality homes and building wider communities. The BTR sector can greatly help in delivering much needed new homes, at scale and at pace, which meet local need.”

Sandra Jones, Managing Director at PriceHubble said: “There is a growing awareness in the BTR industry, that it has a key role to play in providing homes for the ‘squeezed-middle’ who are renting through more life-stages and want long-term housing solutions - well-built, well-managed and affordable - where they can put down roots. The analysis of income and affordability for this report, is the evidence that the sector is delivering on that.”

The full report, Who Live in Build to Rent? is available on the BPF website here.

Latest Releases

Core Cities and Devolution

BPF response to the second reading of the English Devolution & Community Empowerment Bill

Read more