Who are property investors?

Property investors pool together money from institutional investors such as pension funds, insurance companies and family offices and are the conduit through which the long-term savings of millions of people get invested in towns and cities across the country. In other words, most people with a pension fund or life insurance policy are ultimately property investors and as much as £250bn of commercial property is owned by the general public.

How does savers’ money get invested?

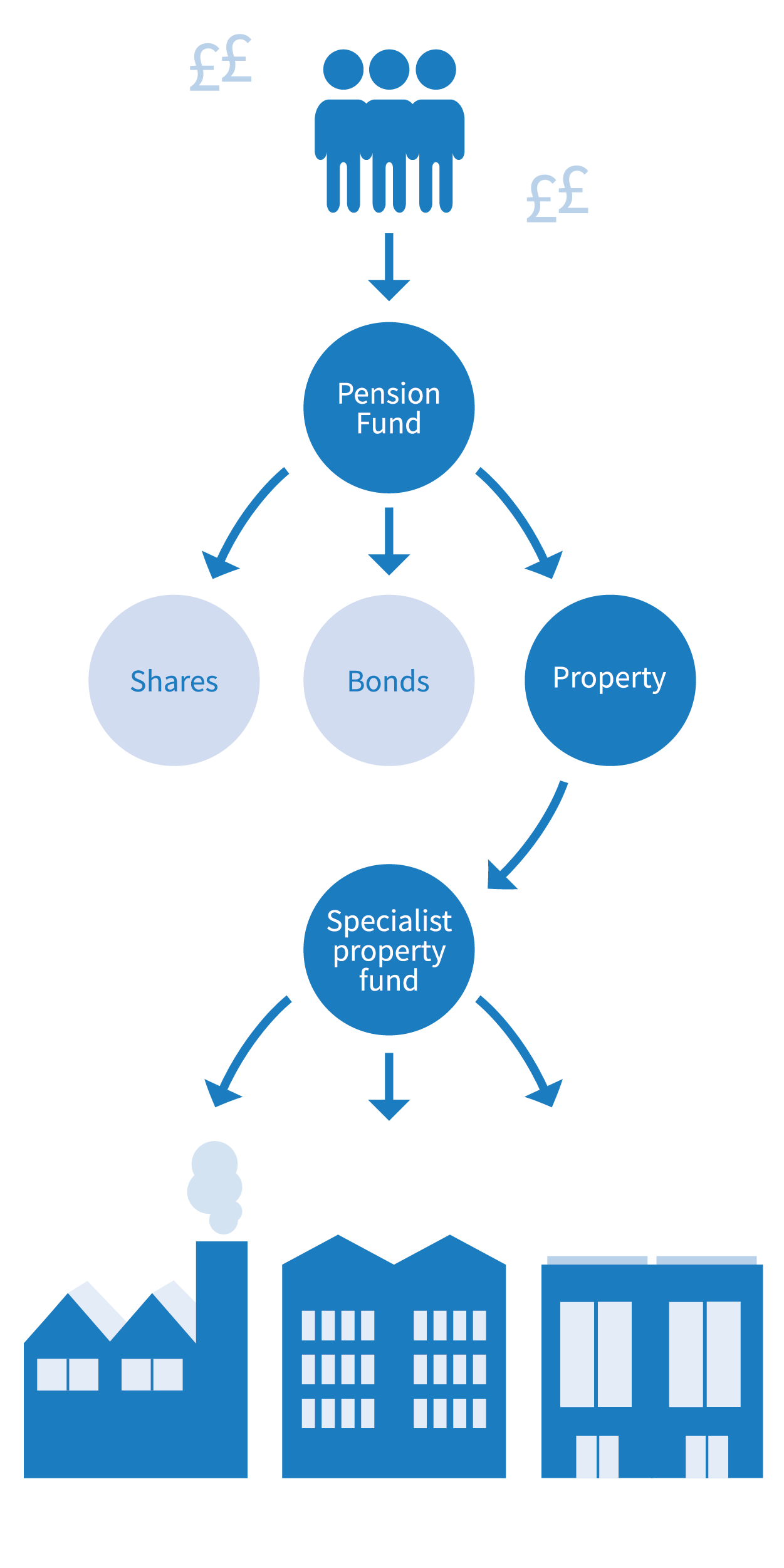

The diagram to the right shows how money from people’s savings ends up invested in buildings:

- People make regular contributions into their pension funds.

- The managers of those funds use the money to invest in different assets, including shares, bonds and property. The precise mix of these is called asset allocation.

- The allocation to property investment is typically invested in a specialist property fund, run by property professionals with many years’ experience.

- These property funds buy, maintain and sell investment property as necessary to make sure investors get a strong return.

- The returns, which arise from rent paid by businesses occupying the property and any gains made from selling property, are distributed to investors and ultimately find their way back to people’s pension funds.

Are there different types of property investor?

All property investors are broadly aiming to achieve the same thing – to deliver returns for their investors by owning and operating property. However, there are different ways of categorising property investors.

Equity investors use their capital to buy property and get a return from rents and gains on sale. Debt investors use their capital to lend to equity investors. Equity investment has the potential to deliver higher returns, but is usually more risky than debt investment

Owning an office building in the middle of a large city is a very different proposition to owning a shop on the high street of a small town, with a different set of risks and rewards. The higher the risk, the higher the potential return. Property investors will typically own property within a certain risk banding, or will make sure that their investment portfolio as a whole meets that risk banding. Risk appetite will vary considerably by investor.

Some property investors specialise in particular types of asset (e.g. retail, offices, logistics, healthcare). Other property investors are more generalist, which means they may be more insulated against structural economic changes, but may lack the institutional expertise of specialists.

Property investors use a variety of different legal entities to own property depending on who their investors are and what their investment aims are, including:

Limited companies – like those used by businesses across the economy. These can be public (i.e. listed on a stock exchange) or private.

REITs – these are listed property companies subject to special tax rules that mean they pay no corporation tax. In exchange, they have to comply with a number of conditions like distributing most of their income to investors every year and withholding tax on those distributions.

Open-ended property funds – these funds can issue new shares or units at any time. This means that the process of raising new capital for investment is much easier than it is for listed companies and REITs. However, like REITs, they are subject to special rules of their own.

Closed-ended property funds – these funds typically require investors to commit to a minimum holding period and offer only limited opportunities to sell their shares or units. This gives the fund long term certainty about the capital available to it and this model is often used by private equity real estate (PERE).

Limited companies are typically managed “internally”, i.e. by employees of the company or group of companies that owns the property investments. Many REITs are also internally managed.

Open-ended and closed-ended funds (and also some REITs) are typically “externally” managed, i.e. by a specialist property fund manager with whom they have a contract for fund management services.