Long-term shortage of logistics space could restrict economic growth and undermine ‘levelling up’

- Report from British Property Federation and Savills shows planning policy has restricted development of ‘critical national infrastructure’ for past decade and suppressed demand

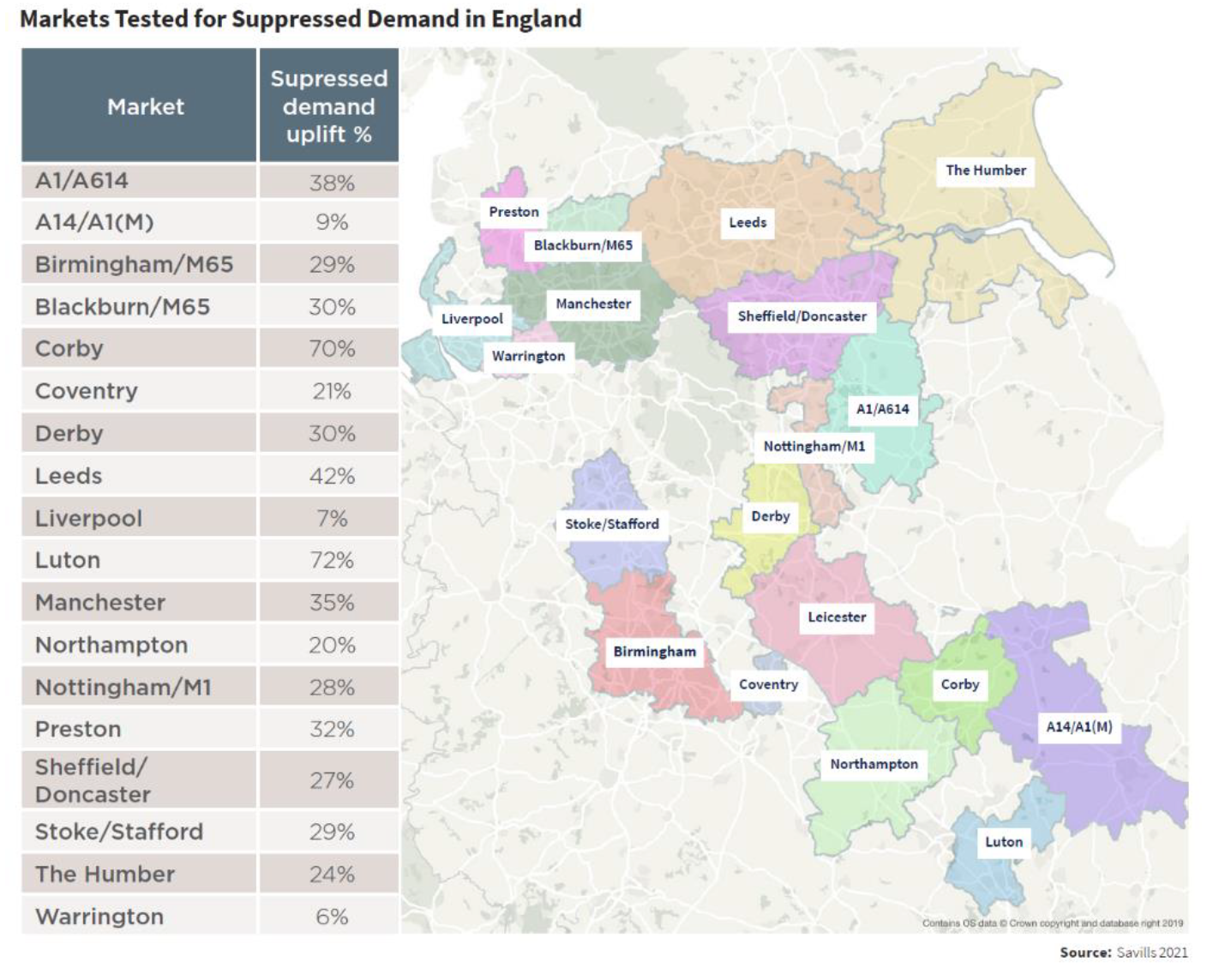

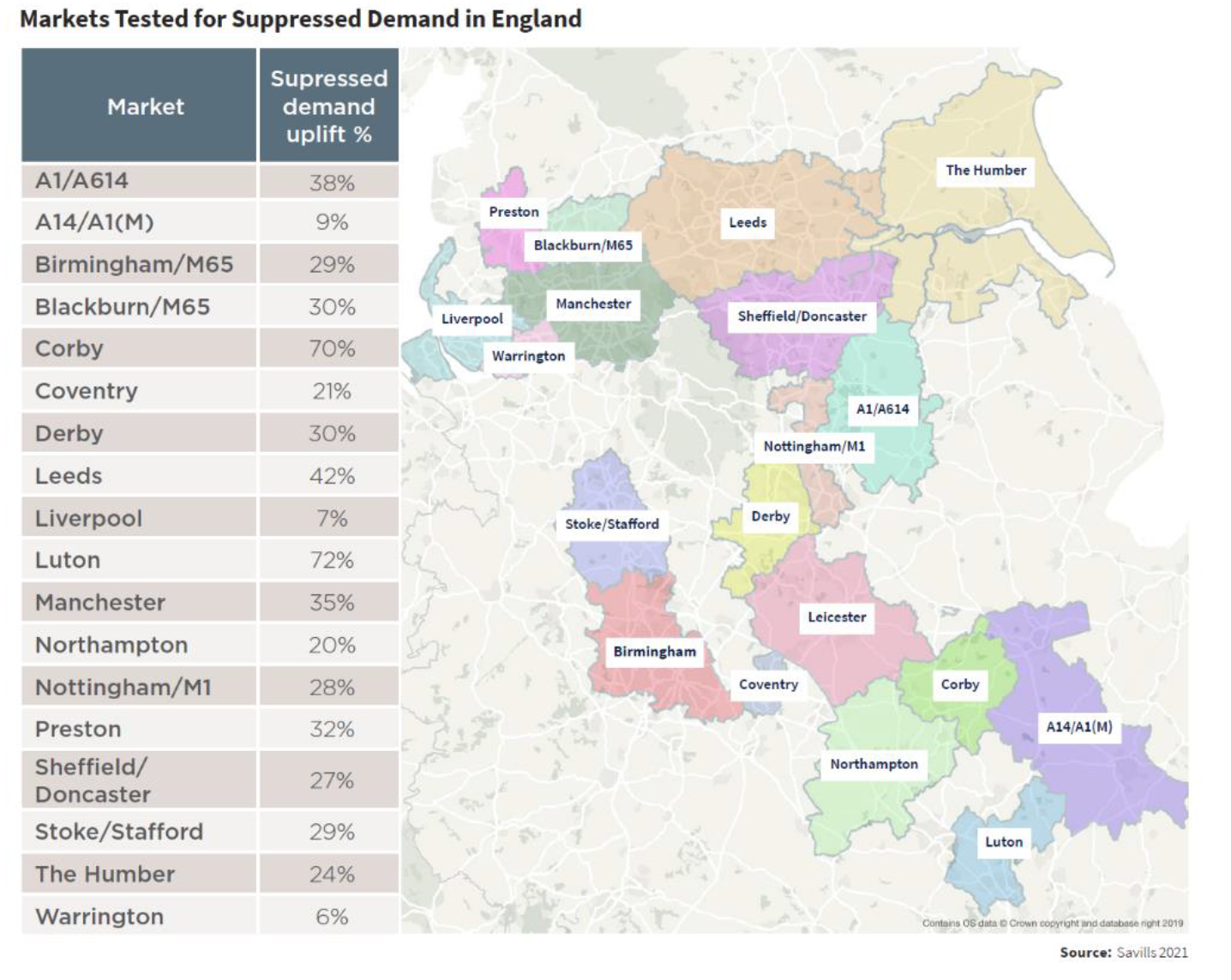

- New analysis shows real demand for warehouse space is at least 29% higher across the UK than historic take-up levels suggest

- Logistics and industrial space makes vital economic contribution, supporting 3.9 million jobs and driving urban regeneration and housing delivery

A report published today by the British Property Federation (“BPF”) and Savills shows that demand for industrial and logistics space across England has been underestimated in planning policy for a decade, and future demand is likely to be at least 29% higher than past levels. The report, Levelling Up – The Logic of Logistics, examines how national planning policy and increased housing targets have restricted the development of space for the logistics sector, which employs 3.8 million people, accounts for 14% of the economic output in England and is a catalyst for job creation, improvements to road and rail infrastructure and housing delivery. The analysis, undertaken in partnership with the UK Warehousing Association and a number of leading industrial developers, shows that the long-term shortage of supply has suppressed demand for logistics space, in key markets throughout the country. The report finds that additional development could unlock significant additional demand and wide socio-economic benefits, with future demand for logistics space calculated to be at least 42% higher in Leeds, 35% higher in Manchester, 29% higher in Birmingham and 28% higher in Nottingham than current levels.

Gwyn Stubbings, Planning Director at GLP and Chair of BPF’s Industrial Committee said:

“The Covid-19 pandemic has demonstrated that our industrial and logistics facilities are a key part of the nation’s critical national infrastructure.

“Alongside our supply chains, they support the functioning of a strong economy and the way we live our lives by ensuring we have what we need at the right time. They are as crucial as the roads, rail, airport and port facilities needed to move goods around the country.

“Enabling the sector to reach its full potential is essential to driving economic growth but our planning system remains a barrier by not allocating enough land in appropriate locations. If the industrial and logistics sector is to play its full part in the economic recovery and levelling up it is vital that we create a more agile planning system which is more responsive to the sector’s needs.”

The report argues that the supply-demand dynamics of warehouse space have been distorted since 2011, with annual take-up averaging 34 million sq ft (net) over that period, 46% higher than the net delivery of new space. This chronic shortage of warehouse space has seen rents rise 61% - more than twice the rate of inflation – and the national vacancy rate stay consistently below the ‘equilibrium’ rate of 8% which the report demonstrates is the level at when demand and supply are broadly in balance.

The BPF has called for greater support for industrial and logistics space as critical national infrastructure within national planning guidance. Its recommendations in its Employment Land Manifesto, published in 2021 included:

- Binding targets for delivery of employment space, including logistics space, alongside housing targets

- Introduce a presumption in favour of logistics space where sites meet certain criteria around transport connectivity and appropriate for the development of large buildings

- Modernise Employment Land Reviews so that real time information on trends such as ecommerce growth inform allocation of land for logistics

- Ensure logistics are planned for separately to other industrial uses in Local Plans

- Adaptation of Design Codes to be appropriate for logistics developments

Melanie Leech, Chief Executive of the British Property Federation, said:

“For over a decade planning policy has underestimated the need for logistics space in and around major population centres to support the growth of e-commerce and create robust and resilient supply chains. Demand for warehouse space is currently at an unprecedented level, but future demand is likely to be significantly higher as the digital economy continues to expand, and supply chains are reconfigured post-Brexit. It is therefore imperative that we find new ways to complement the delivery of housing with modern warehouse facilities, which will support jobs and growth and help revitalise regional economies.”

Kevin Mofid, Head of Logistics and Industrial Research, Savills, added:

"Historically a key barrier to bringing forward new industrial and logistics development has been the reliance on using historic data to project future demand. Our research has found that these outdated methodologies are significantly underestimating the future demand for good quality and well located premises. By having more accurate methods to calculate how much space is required in the future local authorities will be better placed to plan for effectively for the sector's needs and capture the economic, social and environmental benefits new development can bring to an area."

Latest Releases

Core Cities and Devolution

BPF response to the second reading of the English Devolution & Community Empowerment Bill

Read more